- Chubby Wallet

- Posts

- Why rental listings are rising..

Why rental listings are rising..

analysing the impact of the renters reform act

Hi there,

This is Chubby Wallet. The newsletter that teaches you how to profit from property trends before they go mainstream..

Here's what’s in store..

Rental listings rise by 25% despite Renters Right Act

Total volumes remain very high

Leasehold flats to be banned..

LATEST DEVELOPMENTS

RENTALS

Rental listings rise by 25%

Rental listings rose sharply at the end of 2025, not because landlords rushed to sell, but because tenants stopped moving. The coming Renters’ Rights Act has made renters cautious, creating a temporary rise in available homes. This looks like a pause in activity, not a lasting increase in supply.

The details:

Rental stock jumped late in the year: Available rental homes in England rose 25% in Q4 2025 compared with Q3, and were up 15.4% year on year (Rightmove data analysed by Inventory Base). This was a much larger seasonal rise than seen in Q4 2024.

This is not a landlord sell-off: Despite fears that the Renters’ Rights Act would trigger mass exits, the data shows no sudden drop in landlord numbers by late 2025. According to Inventory Base, the total number of rental homes has not changed much.

Tenant behaviour is the main driver: Siân Hemming-Metcalfe of Inventory Base says the Act “changes the risk profile for private landlords” by limiting how risk can be managed during a tenancy. But she notes the Q4 data shows something else happening first: tenants delaying moves.

Tenants are waiting for stronger protections: From mid-2026, no-fault evictions end, fixed terms disappear, and security of tenure increases. Knowing this, many tenants are choosing to stay where they are. When fewer tenants move, homes stay listed for longer and stock builds up.

Quarterly increases in available stock were highest in:

– Bristol: +74.8%

– Leicestershire: +67.6%

– Tyne & Wear: +66.7%

– Warwickshire: +66.4%

– West Yorkshire: +65.2%

Rutland (+61.5%) and Merseyside (+60.1%) also saw large rises.

London was the only region where stock fell:

– City of London: -14.1%

– Greater London: -2.4%

This suggests demand remains strong, or tenant behaviour is different in higher-cost markets.

Why It Matters

This data shows how regulation changes behaviour before it changes supply. The late-2025 rise in rental listings is a timing effect, driven by tenants waiting, not a sign the rental market has loosened for good. Once the new rules are in force, tenant movement may pick up again, and the temporary increase in stock could fade. The bigger supply question depends on how landlords respond after 2026, not before it.

STOCK LEVELS

House listings remain very high..

Early 2026 opened with high supply, steady transaction volume, and clear price tension between sellers and buyers. Listings are elevated, deals are still happening, but buyers are pushing back hard on price. Rental supply is also rising, easing pressure at the margin.

The details

Listings remain very high: By week 2 of 2026 (week ending 11 January), total listings reached 61,351, slightly above the same point in 2025 (61,161). This follows record Boxing Day listings reported by Rightmove, contributing to a glut of homes coming into January.

Homes on the market at decade highs: There were 613,882 homes for sale at the start of January 2026, a 10-year+ record. For comparison, January 2025 began with 605,088 homes on the market.

Price cuts are frequent, but stabilising: Only 7.6% of homes were reduced in December 2025. Across the whole of 2025, the monthly average was 12.8% (just over 1 in 8 homes). Around 20,000 reductions in December were fewer than early 2025 (21,690), but still high relative to any year since 2017.

Big gap between asking prices and deals done: Average listing price in week 2 was £423,000. Average price on homes sold subject to contract was £346,000.

That is a 22.2% gap, well above the normal 16–17% range seen in more balanced markets.Transaction volumes look healthy: Sales agreed rose to 21,200 in week 2, up from 17,000 in week 1. Net sales were 15,800, ahead of the 10-year average of 14,400, suggesting buyers are active when prices adjust.

Prices agreed are broadly flat: Prices per square foot agreed in December 2025 were 0.6% higher year on year, roughly matching Nationwide’s estimate for full-year 2025 house price growth. Distortions from budget speculation mean near-term Land Registry data may remain subdued.

Why It Matters

This snapshot shows a market defined by volume, not momentum. Supply is abundant, sellers are ambitious, but buyers are disciplined. Deals are getting done only where prices reset to reality. The widening gap between asking and agreed prices suggests further negotiation ahead, not a sudden price rebound. Rising rental supply reinforces the same theme: conditions are becoming more balanced, reducing urgency on both sides of the market.

REGULATORY UPDATE

LEASEHOLD REFORM

Leasehold flats to be banned

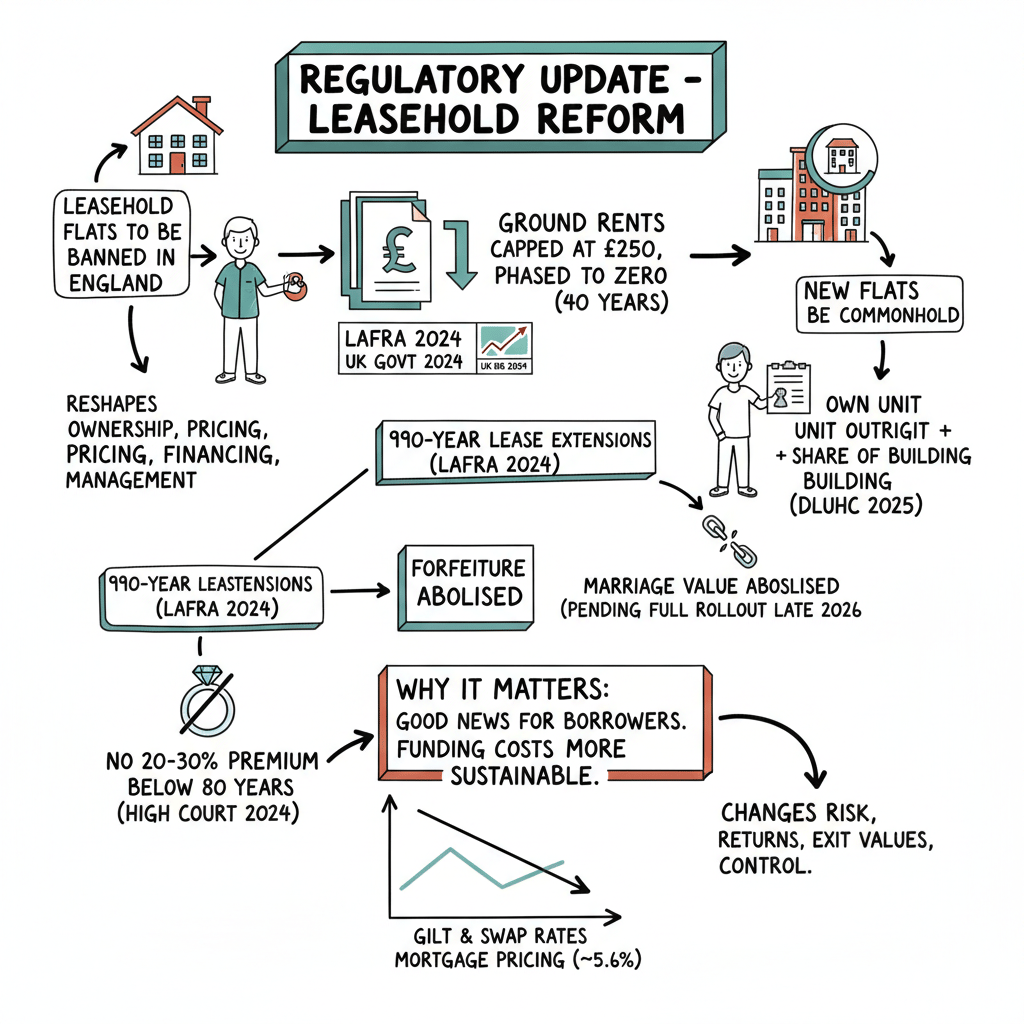

The UK is dismantling the leasehold system and replacing it with commonhold. By 2026, this will reshape how flats are owned, priced, financed, and managed. For investors in the living sector, this changes risk, returns, exit values, and control—especially in blocks of flats, retirement living, and supported housing.

The Details:

Ground rents capped at £250, then phased to zero: Most existing ground rents are now capped at £250 and will be reduced to zero (“peppercorn”) over the next 40 years under the Leasehold and Freehold Reform Act 2024 (LAFRA) and follow-on legislation (UK Government, 2024).

New flats must be commonhold: New-build flats can no longer be sold as leasehold. Ownership must be commonhold, meaning buyers own their unit outright plus a share of the building and land (DLUHC policy paper, 2025).

990-year lease extensions: Leaseholders can extend to 990 years, removing repeat extension risk and long-term value erosion (LAFRA, 2024).

Forfeiture abolished: Freeholders can no longer take a property for small debts like unpaid service charges—removing a major historic risk for owners and lenders (UK Parliament briefing, 2025).

Marriage value abolished (pending full rollout): Once fully implemented (expected later in 2026), freeholders will no longer take a 20–30% premium when leases fall below 80 years (High Court upheld the policy in 2024; implementation timetable set by DLUHC, 2025)

Why it matters

Lower gilt and swap rates provide a small boost for mortgage pricing. Currently, new mortgage debt is priced around 5.6% when including fees. This week’s changes don’t signal a big shift yet, but they bring some rare good news for borrowers. They suggest that funding costs might be moving towards a more sustainable level.

That's it for this week folks. Each week we'll cover strategies, updates and insights to help you succeed in real estate. We love this stuff!

If you Have questions or just want to chat, We want to hear it.

See you next time in your inbox!

What did you think of this Newsletter?

🤜🤛 Loving Chubby Wallet? Make our day and forward this to a friend.