- Chubby Wallet

- Posts

- The best areas to buy in 2026

The best areas to buy in 2026

Hotspots revealed..

Hi there,

This is Chubby Wallet. The newsletter that teaches you how to profit from property trends before they go mainstream..

Here's what’s in store..

The best areas to buy in 2026

Uk residential auctions set to rise.

New Renters’ Rights Act rules launch in May

LATEST DEVELOPMENTS

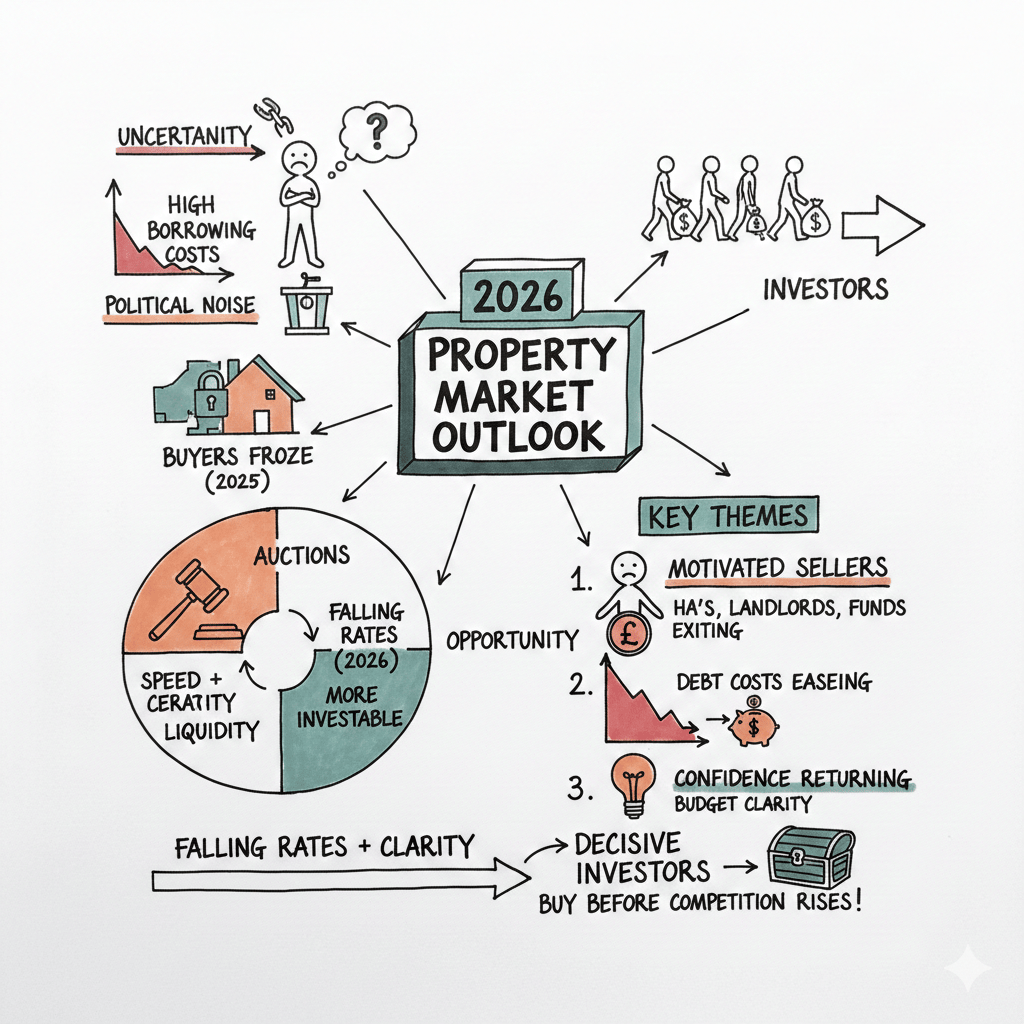

2026 Outlook

The best areas to buy in 2026

According to Property Hub, the 2026 property market is splitting clearly by region. High prices and new taxes are weighing on London and the South. Capital is moving north to places with lower entry prices, stronger rental demand, and clearer growth drivers. Investors who focus on affordability, regeneration, and rental quality are best placed to benefit.

The details

The North–South divide is widening: London and the South face high entry costs and added tax pressure on expensive homes. This caps upside. More affordable regions are attracting both buyers and renters, creating better risk and return balance.

High-growth areas are mostly in Scotland and the North West: Price growth forecasts point north. Scotland is expected to lead the UK, with Motherwell, Glasgow, Paisley, and Falkirk among the strongest areas. In England, Wigan ranks highly for growth potential, followed by Liverpool and Manchester.

Entry price matters more than ever: Professional investors are avoiding expensive markets and focusing on places where average prices are below £250,000 but rents are rising. Cities like Sheffield and Derby fit this profile.

Regeneration and jobs are key filters: Before buying, investors are checking three basics: Is there a major regeneration or transport project underway? Does the local economy rely on more than one industry? Do rents support both yield today and growth tomorrow?

The rental market is resetting: The Renters’ Rights Act coming into force in 2026 raises standards and shifts tenancies to open-ended terms. Poor-quality stock becomes harder to run. Well-finished, energy-efficient homes see stronger demand and lower tenant turnover.

Debt is becoming usable again: Forecasts point to base rates settling around 3 to 3.5 percent by late 2026. This is cheaper than recent years and makes leveraged investing viable again, especially outside the South.

Affordability is improving slowly: Wage growth is currently higher than house price growth. This supports demand and reduces downside risk in more affordable regions.

Why it matters

Returns in 2026 are less about chasing the biggest city and more about choosing the right structure. Lower-priced northern markets offer better yields, stronger rental demand, and more room for growth. As regulation tightens and rates ease, capital flows toward quality homes in affordable cities. Investors who focus on price discipline, local jobs, and rental quality can benefit while others remain stuck in expensive, low-growth markets.

AUCTIONS

Residential auctions set to rise..

2026 is shaping up as a transition year for auctions. Falling interest rates and improving stability won’t trigger a boom, but they will keep auction rooms liquid. Development stress, planning delays, and cautious sentiment mean auctions remain the fastest route to certainty, especially for sellers under pressure.

The details

Development stress feeds auction supply: Many sites have been unviable for three to five years due to high finance and build costs. These stalled or marginal schemes are increasingly coming to auction as owners seek an exit rather than wait for conditions to fully improve.

Falling rates widen the buyer pool at auction: Lower borrowing costs improve deal viability before confidence returns to the wider market. Auctions benefit early because buyers can price opportunities quickly and act decisively.

Land and consented sites will dominate catalogues: As developers begin testing the market again, auction catalogues are seeing more land, permitted sites, and part-built schemes. These assets trade better in auctions than private treaty because price discovery is immediate.

Speed and certainty matter more than price: With planning delays and funding risk still high, sellers prioritise certainty of sale. Auctions remove long negotiation timelines and funding fall-through risk, which remains elevated outside auctions.

Planning friction keeps distressed stock flowing: Slow, costly planning continues to push frustrated owners toward auction sales. This keeps a steady pipeline of motivated sellers even as headline conditions improve.

Measured confidence supports clearance rates: Buyer sentiment is improving cautiously. That typically supports solid success rates rather than aggressive bidding, favouring well-priced lots over speculative schemes

Why It Matters

Auctions sit at the front of the cycle. They capture forced and motivated selling before recovery narratives take hold. For investors, this creates a window where pricing reflects past stress, not future stability. As finance costs fall and development viability slowly returns, auction-bought assets—especially land, consented sites, and value-add stock offer huge upside once confidence and construction activity follow

REGULATORY UPDATE

RENTERS RIGHT ACT

Renters right act to launch in May

The Renters’ Rights Act (effective 1 May 2026) materially increases cost, friction, and risk for private landlords. The result is not a rental crash, but accelerated landlord exits. That exit flow disproportionately channels into auctions, making them the main release valve for the private rented sector as regulation tightens.

The Details:

The Death of "No-Fault" Evictions: The headline change is the total abolition of Section 21. Currently, a landlord can ask a tenant to leave without giving a reason. From May 2026, they must provide a valid legal reason (under Section 8) to end a tenancy.

All Tenancies Become "Rolling" Fixed-term contracts will disappear: Every tenancy will be periodic (rolling month-to-month) from day one. This means tenants have more flexibility to leave, while landlords cannot "lock" someone into a contract.

Two Months’ Notice to Leave Under the new rolling system: tenants can end their tenancy at any time by giving two months’ notice. This replaces the old system where you might be stuck until the end of your fixed term.

Bidding Wars are Banned: Landlords and agents will be legally required to publish a set asking price for rent. They are strictly prohibited from inviting, encouraging, or even accepting offers that are higher than the advertised price.

Rent Increases: Once a Year Only Landlords can only raise the rent once every 12 months. They must use a formal "Section 13" notice and give you at least two months' warning. The increase must reflect the actual market rate, not an arbitrary number.

The Right to Request a Pet: You now have a legal right to request a pet, and landlords cannot "unreasonably" refuse. However, landlords can require you to take out insurance to cover potential pet damage to the property.

No More "No DSS" or "No Kids”: It will be illegal for landlords or agents to have blanket bans on people who receive benefits or families with children. They must assess every applicant based on their individual financial ability to pay.

A New "Decent Homes Standard" For the first time, private rentals must meet a specific Decent Homes Standard. Properties must be free from serious hazards, be in a reasonable state of repair, and have modern facilities.

Awaab’s Law: Fixing Hazards Fast Named after a toddler who died from mould exposure, this law requires landlords to investigate and fix serious hazards like damp and mould within strict, legal timeframes. If they don't, they face heavy fines.

The Digital Landlord Database & Ombudsman: A new National Landlord Database will be created. All landlords must register, allowing tenants to check their history. Additionally, a Landlord Ombudsman will provide a free way for tenants to settle disputes without going to court.

Why it matters

The Act raises operating costs and complexity for landlords, while shortening tenancy certainty. Investors need to focus on higher-quality, compliant properties, as regulatory pressure will drive up demand for well-managed stock. Income stability and tenant retention become premium factors. Assets that meet the new standards will outperform, while older, non-compliant stock may see higher voids, maintenance costs, and risk-adjusted yields.

That's it for this week folks. Each week we'll cover strategies, updates and insights to help you succeed in real estate. We love this stuff!

If you Have questions or just want to chat, We want to hear it.

See you next time in your inbox!

What did you think of this Newsletter?

🤜🤛 Loving Chubby Wallet? Make our day and forward this to a friend.