- Chubby Wallet

- Posts

- Lloyds bank is quietly cornering the rental market

Lloyds bank is quietly cornering the rental market

50k home target by 2030..

Hi there,

This is Chubby Wallet. your cheat code for becoming ‘the smartest person in the room’ when it comes to UK property..

Here's what’s in store..

Lloyds moves from lender to landlord

How the UK created “generation rent”

What new rights will tenants get in the renters’ reform bill?

LATEST DEVELOPMENTS

HOUSING

Lloyds Bank: your savings, their portfolio

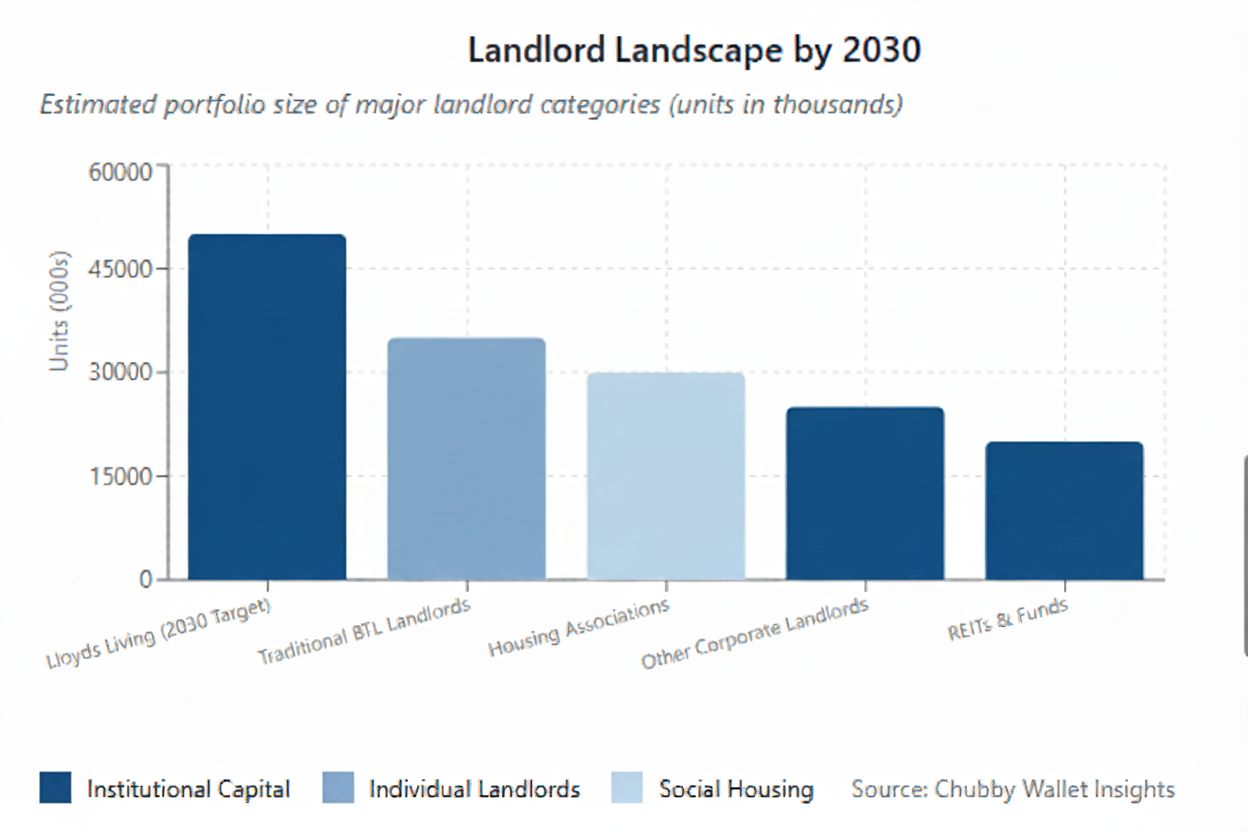

Lloyds Bank is no longer behaving like a bank. It’s quietly positioning itself to become the UK’s dominant private landlord. With a goal of owning 50,000 homes by 2030, what appears as bold corporate strategy is raising concerns that one institution is gradually monopolising the UK housing market

The details:

Lloyds closed almost 300 bank branches yet increased profits.

Through Lloyds Living, they already control around 12,000 homes. That number alone makes them one of the largest landlords in the country.

The capital comes from retail deposits. You earn pennies on your savings. They use those same deposits to acquire the very homes ordinary buyers struggle to afford, then rent them back to the public.

Lloyds also owns the mortgage distribution channels. They underwrite the loans, decide credit risk, and increasingly own the stock people want to borrow against.

When the lender and landlord collapse into the same entity, the traditional route into ownership becomes harder by design, not by chance.

Their largest shareholder is BlackRock, a global fund that views residential property not as shelter but as a yield-producing system.

Why It Matters

This is not a story about one bank buying houses. It is a story about the direction of the housing system itself. As smaller landlords exit and big money steps in, the game changes: Homeownership is slowly becoming a corporate asset.

For the regular investor, the opportunity is not to fight the institutions at their game but to operate where they cannot. Large players need scale, predictability and a uniform product. They struggle with small, complex, local, value-add assets - the very spaces individual investors can still win in.

RENTAL MARKET

How the UK created “generation rent”

The latest English Housing Survey shows a quiet but dramatic shift: older households now own most of England’s housing wealth outright, while younger buyers increasingly rely on 30-year mortgages just to get onto the ladder. This isn’t temporary, it’s a new system that means lots of people will rent forever and older folks hold the wealth.

The details

Older owners now dominate the market: 62% percent of outright owners are 65+, and nearly 80% of older households own their homes. Housing wealth has settled into the hands of an ageing group that has no pressure to sell and no exposure to interest rates.

Younger buyers borrow time to survive high prices: The average first-time buyer is now 34 (35 in London). 62% take mortgages of 30 years or more. Before the pandemic, it was 47%. Instead of improving affordability, the system stretches repayment periods so buyers can tolerate higher prices and higher rates.

Only higher-income households can still buy. Most new buyers come from the top two income groups. The average deposit is over £78,000. Buying has become a gated market.

Regions are splitting in two: London has only 23% outright owners because its residents are younger and carry more debt. Northern regions, like the North East, now have much higher levels of outright ownership

The rental market becomes the overflow tank: People who cannot save £80k or qualify for a 30-year loan stay renters for longer. This creates a built-in, long-term demand pipeline for the PRS, not because renting is desirable, but because ownership is out of reach for millions.

Why It Matters

The English Housing Survey shows older households own most home equity, while younger ones face growing debt. Long mortgage terms trap a generation in renting. For investors, this signals strong, steady rental demand driven by the housing system’s design. Opportunity lies in providing affordable, quality rental homes for those unable to buy.

REGULATORY UPDATE

RENTERS REFORM

Breaking down the renters’ right act

The Renters’ Rights Act looks like a list of tenant-friendly rules, but it represents something bigger: a shift toward a more regulated, more transparent and more supervised rental market. These changes don’t just protect tenants; they change how landlords must operate, who can stay in the market, and how future rental supply will be produced

The Details:

No rent bidding: Landlords must advertise one fixed “proposed rent” and cannot accept higher offers. This protects tenants from auctions but removes flexibility, which means many landlords will simply list at a higher starting price.

Mandatory registration: Landlords and properties must be registered before advertising. Tenants get more information, but landlords face more admin and more scrutiny. Over time this centralises data and raises the barriers to entry.

No discrimination against families or benefit claimants: “No DSS” and “no children” rules are banned across adverts, mortgages and insurance. This broadens access, but landlords will rely more heavily on strict income and affordability checks to manage risk.

Pet rules apply only after move-in: Landlords can still market as “no pets,” but once a tenant moves in, they have the right to request a pet unless the landlord has a strong reason to refuse.

Homes must meet a Decent Homes Standard: Councils can fine landlords up to £7,000 and force repairs if a property falls below the standard. This raises operating costs, especially for smaller landlords with older stock.

Periodic tenancies with no fixed term: With effect from 1 May 2026, all Assured Shorthold Tenancies will become Assured Periodic Tenancies (APTs) automatically. Tenants will be able to leave at any time by serving two months’ notice to quit in writing, to expire at the end of a rental period.

Why it matters

These rules raise the cost and complexity of being a landlord. Big, professional operators will adapt easily. Smaller landlords will struggle and many will leave, tightening rental supply and pushing more demand into fewer, better-run homes. For investors who stay in the market, the winning strategy is simple: run clean, compliant property, price fairly and operate professionally.

That's it for this week folks. Each week we'll cover strategies, updates and insights to help you succeed in real estate. We love this stuff!

If you Have questions or just want to chat, We want to hear it.

See you next time in your inbox!

What did you think of this Newsletter?

🤜🤛 Loving Chubby Wallet? Make our day and forward this to a friend.