- Chubby Wallet

- Posts

- Housing markets seeing biggest gains and declines

Housing markets seeing biggest gains and declines

Your guide to decoding the postcodes to avoid

Hi there,

This is Chubby Wallet. The newsletter that teaches you how to profit from property trends before they go mainstream..

Here's what’s in store..

General market update

Where UK house prices are rising and falling the most

Regulatory update

How the rental reform act could change the market

How a London optician built a £b portfolio

In his comprehensive market breakdown released last week, Chris Watkin highlighted that 2025 kicked off with property listings rising 9% above both last year's figures and pre-pandemic benchmarks.

We're witnessing a fundamental shift in market dynamics, this supply surge represents the most significant influx of inventory since 2015.

The flood of properties hitting the market has sellers feeling the pressure:

13.4% of listings have already seen price reductions, eclipsing the 2024 average (12.1%) and the five-year average (10.6%)

In a single week, approximately 25,000 properties nationwide had their asking prices reduced – numbers we haven't seen since 2019 when 19,109 weekly reductions were considered extraordinary

As The Property Chronicle observed last month:

The pricing power pendulum has decisively swung toward buyers for the first time in years

What about actual sales figures?

Despite the price adjustments, properties are still changing hands at an impressive rate.

The latest data shows 27,300 homes achieving "Sold Subject to Contract" (SSTC) status – representing a 14% year-to-date jump versus 2024 and sitting 22% above pre-pandemic levels.

What we're seeing isn't a market freeze, but rather a market correction, Buyers are absolutely active, but they're leveraging their newfound negotiating power to secure better deals.

The economy

In the latest economic report released yesterday, year-on-year GDP growth reached 1.4%.

Unemployment holds steady at 4.4%, but job vacancies are dropping quickly.

This is concerning for smaller businesses that are dealing with recent wage hikes. Inflation eased slightly to 2.6%, down from a forecast of 2.7%.

However, core CPI (a measure of inflation in the UK that excludes the volatile prices of food and energy) remains high at 3.4%.

Bloomberg's chief economist described this as "still uncomfortably high territory."

UK 5-year bond yields dipped to 4.046%. - the implication of this is banks borrow cheaper, passing on slightly lower mortgage rates - helping buyers afford homes.

One Bank of England adviser called this "the first breath of fresh air in an otherwise suffocating market.”

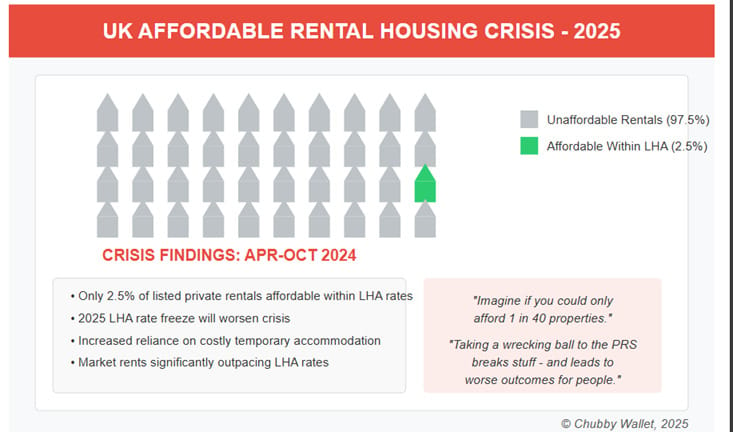

What about the housing crisis?

The rental market in England is in chaos, and things just got even worse, according to Crisis's latest report.

Between April and October 2024, just 2.5% of private rentals were affordable for people getting Local Housing Allowance.

The freeze on LHA rates in 2025 has housing advocates sounding the alarm more loudly than ever.

Crisis is calling for some urgent changes, including:

Big boost in social housing construction

Unfreezing LHA rates

Removing the subsidy cap on temporary accommodation

Restoring funding for housing support services.

So, who has a grasp on the UK property market?

One Treasury official said,

I come from the school that says those predicting nine out of ten corrections often miss the one that's actually coming.

This highlights a key point: no one truly knows what's ahead, but the divides in the economy are hard to overlook.

New figures show UK house prices are still climbing overall — but with growing extremes between regions.

According to the latest official data, the average home rose by 4.9% year-on-year, now valued at £269,000.

But zoom in and the picture gets more uneven: some local markets have seen double-digit gains, while others — particularly in prime London — are facing steep falls.

Here’s where prices are moving fastest, and what’s really driving the shifts.

Top of the list is Blackburn with Darwen in Lancashire. Average prices there jumped 12% in a year.

Blackburn isn’t isolated. Other fast-growing areas include:

Harborough (East Midlands): +10.8%

South Staffordshire (West Midlands): +10.4%

9 of the top 10 growth areas are in the Midlands, the North, or Scotland. Only one is in the South.

Where prices are falling

London’s prime postcodes in retreat at the other end of the spectrum:

City of Westminster: -17.2%

Kensington and Chelsea: -17.1%

Hammersmith and Fulham: -9.2%

The reasons are structural:

A punitive 17% stamp duty on second homes, hitting domestic and international investors hard

Low transaction volumes, where a few lower-value sales skew the data

High ownership costs discouraging buyers in a flat or declining market

“It’s not just taxes — it’s sentiment,” says Stuart Bailey at Knight Frank.

Read the trends, not just the stats

Some agents caution against reading too much into average price changes alone. In ultra-high-value areas like Kensington or Mayfair, a small shift in transaction type (e.g. fewer £10m homes sold) can skew averages sharply.

Still, the direction of travel is clear: value is migrating away from traditional prestige markets to areas with better yield, lower taxes, and stronger demand fundamentals.

Takeaways

Affordability is driving demand in low-cost northern and Midlands markets.

Rising rents are creating urgency for buyers priced out of lettings.

London’s luxury market is becoming illiquid, but still attracts dollar buyers as a global safe haven — albeit fewer of them.

Stamp duty policy is distorting buyer behaviour, creating friction at the top and bottlenecks across the chain.

If you’re buying or repositioning your portfolio, look beyond postcode reputation. The fastest capital growth today is happening in markets that were overlooked five years ago.

Key UK property legislation changes 2025-2026

Renters' Rights Act 2025 (Previously Renters Reform Bill)

Currently in House of Lords, likely to receive Royal Assent by May 2025

Expected to come into force in Q1 2026

Replaces Assured Shorthold Tenancies with new Assured Tenancies

Key Changes for Landlords:

Fixed-term tenancies will be abolished; all existing ones will become periodic overnight

Tenants can terminate any tenancy with at least 2 months' notice

No need to "renew" fixed-term tenancies in 2025

Section 21 will be abolished; landlords can only end tenancies using Section 8 grounds

Rent must be payable in periods of no more than one month (not quarterly or termly)

Landlords cannot request rent in advance

Rent increases must follow the Section 13 notice procedure

Leasehold and Freehold Reform Act 2024

Already on statute books with provisions coming into force gradually

Implementation Timeline:

January 31, 2025: Abolition of the "two-year rule"

Leaseholders no longer need to wait two years after purchase before extending lease or buying freehold

March 3, 2025: Right to manage provisions

Expanded access, reformed costs and voting rights

More leaseholders in mixed-use buildings can take over management

Leaseholders no longer need to pay freeholder's costs in most cases

Upcoming Consultations:

Early 2025: Consultation on service charges and commissions

Addressing unfettered increases in service charges

Addressing commissions on insurance charges received by managing agents/freeholders

Summer 2025: Consultation on enfranchisement premiums

Addressing "serious flaws" in calculating costs for leaseholders to buy/extend leases

Primary legislation needed to fix issues and approve secondary legislation

During 2025: Consultation on "fleecehold" estate management charges

Protections for residential freeholders from unfair charges

Improved access to information, right to challenge reasonableness, and tribunal options

Leasehold and Commonhold Reform

Draft Leasehold and Commonhold Reform Bill expected in second half of 2025

White Paper on transition from leasehold coming in early 2025

Key Reforms:

Making commonhold the default tenure by 2030

Consultation on banning new leasehold flats

Engagement on converting existing flats to commonhold

Ending the right for freeholders to forfeit a lease

Addressing ground rent issues

About Commonhold:

Alternative to leasehold, similar to strata/condominium systems in other countries

Allows flats to be owned on a freehold basis

No lease required Management controlled by a commonhold association of all unit holders

Originally introduced in 2002 but never widely adopted

Stamp Duty Land Tax (SDLT) Increases

Increased by £2,500 from April 1, 2025 for properties over £250,000

Also affects first-time buyers purchasing property over £300,000

Price threshold | SDLT 1 Jan 2025 | SDLT 1 APR 2025 |

|---|---|---|

£250k - investor | £12,500 | £15,000 |

£250k - main residence | £0 | £2,500 |

£250k - FTB main residence | £0 | £0 |

£500k - investor | £37,500 | £40,000 |

£500k - main residence | £12,500 | £15,000 |

£500k - FTB main residence | £3,750 | £10,000 |

The UK rental market is under pressure — and it’s not just about high mortgage rates anymore.

A new piece of legislation, the Renters’ Rights Bill, could reshape the entire sector. But not necessarily in the way policymakers hope.

It could trigger a significant shift in supply, pricing, and the landlord-tenant dynamic — with ripple effects across the entire housing ecosystem.

And experts are raising serious concerns about unintended consequences….

Oli Sherlock, Insurance Director at Goodlord, warns:

this could be the final straw for thousands of smaller landlords, who make up the backbone of the UK’s rental market.

That’s not hyperbole — 80% of landlords in the private sector own just one or two properties.

Here’s what’s most concerning:

The removal of Section 21, or “no fault” evictions, means landlords will only be able to reclaim their properties through the courts. That increases the risk of lengthy legal battles, higher costs, and more rental arrears.

The proposed ban on bidding wars may seem fair, but it could backfire. If landlords can’t accept offers above asking price, many will simply raise the asking price from day one — especially in high-demand areas. This could drive up rents across the board.

Tenants could be two months in arrears before eviction proceedings begin, and possibly three with extensions. That’s a long time for a landlord to cover mortgage payments with no income, especially during a cost-of-living crisis.

“The goal should be speedy resolution for both sides,” says Sherlock.

Instead, this Bill could increase personal debt, drive up evictions, and reduce access to rental homes.

Landlords Are Quietly Leaving

The biggest problem isn’t loud — it’s quiet. Landlords are exiting the market.

Some are selling up. Others are deciding not to reinvest or expand their portfolios. And new entrants? Many are thinking twice.

This is happening at the same time that:

Rental demand is at record highs, driven by population growth, immigration, and rising barriers to homeownership.

Affordability is stretched, with many tenants spending 35–45% of their income on rent.

Mortgage rates remain elevated, with limited relief expected until at least late 2025.

When supply falls and demand rises, prices only go one way — up. We’re already seeing this play out in the South East, Bristol, Manchester, and other rental hotspots.

The Student Market

Calum MacInnes, Chair of SAPRS, points out another overlooked issue:

The risk to student housing:

Students rely on fixed-term contracts that align with academic calendars. Removing them, as proposed in the Bill, could create massive disruption — and deter landlords from serving this segment altogether.

That’s not just a housing issue. It’s a higher education issue. And it highlights a larger theme: when laws don’t reflect how people live, markets break down.

What’s Next

Institutional investors and larger landlords may benefit from reduced competition as smaller players exit.

Investors who focus on energy efficiency, compliance, and long-term value will be better positioned to weather regulatory changes.

Areas with strong employment, good transport, and limited new supply will see the strongest rental growth.

Final Thoughts

This isn’t a market in crisis — yet. But it is a market under strain.

Smart investors will recognize the risks, but also the opportunities.

As with any market cycle, those who understand the deeper shifts — not just the surface noise — will be best placed to make confident, informed decisions.

If you’re investing in or operating within the rental sector, now’s the time to stay sharp, stay compliant, and stay informed.

Ian Livingstone started out as an optometrist, not a developer.

After building and selling a successful retail optics chain with his brother, he used the proceeds to dive headfirst into real estate — and never looked back.

They scaled aggressively but quietly, backing bold deals like the £600m Waterloo project, the redevelopment of 55 Baker Street, and even a $700m mega-development in Panama.

Backed early by Rothschild’s Dawnay Day, they played the long game: buy, reposition, hold.

What drove them?

Self-imposed pressure.

Ian created high-stakes situations to force growth, pushing into risk zones most would avoid.

Key Lessons:

Pivoting works if you stack skills, not just money.

Quiet execution beats loud branding.

Pressure isn’t a problem — it’s a tool.

Long-term thinking wins the real game.

Bottom line: Ian’s story proves you don’t need to start in property to dominate it. Just the vision, the guts, and a refusal to stay small.

That's it for this week folks. Each week we'll cover strategies, updates and insights to help you succeed in real estate. We love this stuff!

If you Have questions or just want to chat, We want to hear it.

See you next time in your inbox!

What did you think of this Newsletter?

🤜🤛 Loving Chubby Wallet? Make our day and forward this to a friend.