- Chubby Wallet

- Posts

- Best UK cities for auction deals right now

Best UK cities for auction deals right now

London, SE, Wales see weaker totals..

Hi there,

This is Chubby Wallet. The newsletter that teaches you how to profit from property trends before they go mainstream..

Here's what’s in store..

General market update

Best UK cities for auction deals

How this investor made ~£150k profit from auction without spending a penny of her own cash

The market appears to be in a holding pattern. Neither sinking nor rising, simply drifting sideways through the summer holidays.

«But beneath the calm surface, some strong currents are at play»

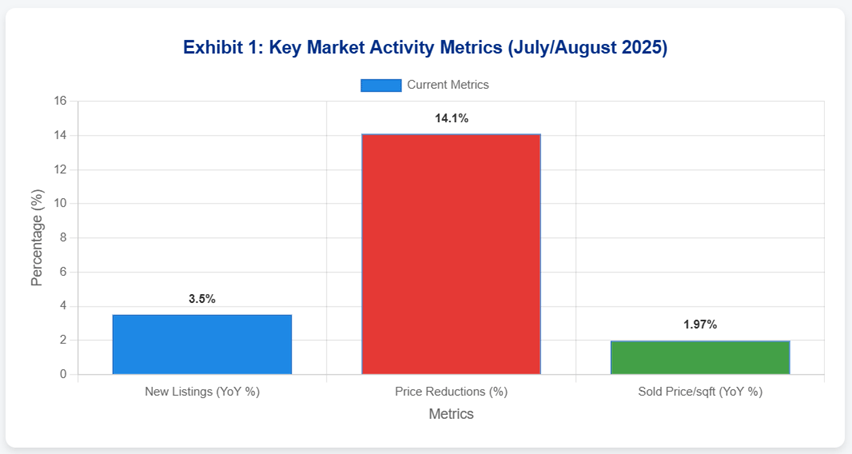

Listings and reductions

Week 32 saw 32,200 new listings (Chris Watkin, Property Industry Eye), only 3.5% above 2024 levels and 7% higher than pre-pandemic.

After two years of “extra” stock, supply is finally aligning with last year’s trend.

At the same time, price reductions are trending up. July saw 14.1% of properties cut their asking price, up from 12.1% a year ago and well above the 5-year average of 10.6%.

Put simply, one in seven homes is being discounted each month—buyers have more room to negotiate than at any point in recent memory.

Sales pace – still surprisingly strong

Despite the “summer slowdown,” 25,000 homes went under offer last week.

That’s almost exactly on the 2025 weekly average (26,500) and 6.9% higher than the same point last year.

Compared to the pre-pandemic market, sales agreed (SSTCs) are up 14.2%.

More listings, more reductions, and more sales?

That points to a functional market—buyers and sellers are finding common ground.

Pricing – sideways Is the new up

On a per-square-foot basis, sold prices are holding steady. July averaged £344.78/sqft, 1.97% higher than July 2024 and nearly 4% above July 2022.

While that lags behind inflation and wage growth, in the current economic climate such stability is notable.

A flat growth trend may not be exciting for homeowners/investors, but it’s a far healthier picture than the sharp swings seen in 2021–22

Inflation & interest rates

Inflation just came in at 3.8% (ONS), nearly double the Bank of England’s 2% target.

Core CPIH—the inflation measure that includes housing costs—was even higher at 4.2%. That puts pressure on the Bank’s rate-cutting ambitions.

UK bond yields have risen to levels not seen since the late 1990s, keeping 5-year mortgage rates stubbornly high even as swap rates have become more affordable.

«Translation: don’t expect a big drop in borrowing costs just yet.»

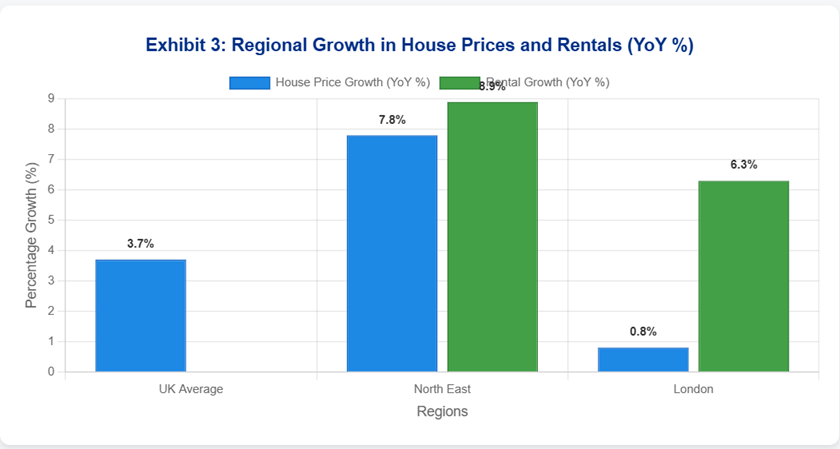

Regional picture

House prices in June were up 3.7% year-on-year, with the North East leading at 7.8%.

London? Barely moved, at just 0.8%. Rental growth tells the same story: the North East is up 8.9%, while London is middle of the pack at 6.3%.

«Yields are rising everywhere, but investors chasing cash flow will find the best opportunities in northern regions.»

Long term though, don’t count the South out. Once lending loosens, London and the South East could stage a catch-up.

Policy watch

The Treasury is testing the waters for stamp duty reform…

Options range from tweaks to a full shift toward a US-style annual property tax. That can mean 2% of your home’s value every year.

«On a £300,000 property, that’s £6,000 annually—much higher than most UK council tax bills. »

For now, it’s speculation. But any policy shift here could reshape mobility, affordability, and investor strategy.

Looking ahead

This summer slowdown looks set to give way to the traditional September uptick in activity.

According to Adam Lawrence of propenomix,:

Expect a clear-out of overpriced “no-hoper” listings and a wave of fresh instructions as school holidays end.

There’s a good chance the market could shift from moving sideways to showing signs of a steady climb by Q4.

Risks remain—persistent inflation, potential rate surprises, and tax reform debates. But the numbers suggest a balanced market, where prepared buyers and realistic sellers can still do good business.

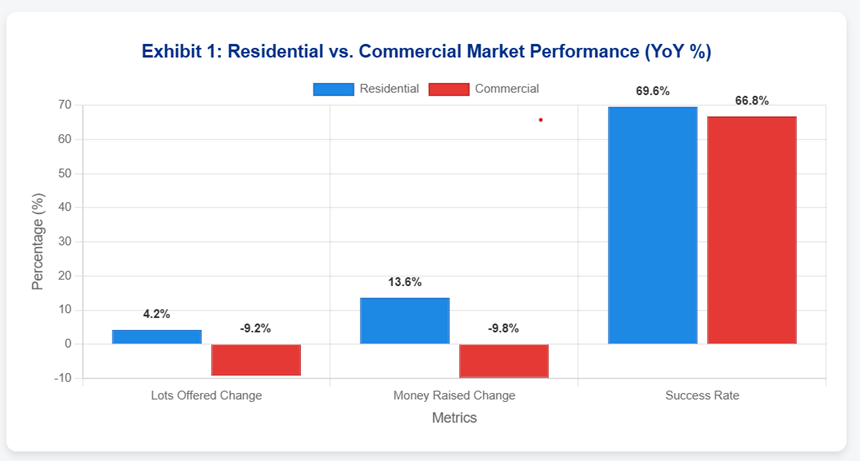

According to EIG auctions, The UK property auction market shows a clear split:

Residential properties are growing strongly while commercial properties are declining

This creates different opportunities across regions and property types.

Key market numbers (July 2025)

Total Lots Offered: 4,532 (↑3.7% YoY)

Success Rate: 69.3% (↓2.8pp YoY)

Total Value: £663.2M (↑8.4% YoY)

Average Lot Value: £211,279 (↑7.6% YoY)

Market split

Residential Market: Growing

4.2% more lots offered

13.6% more money raised

69.6% success rate

Commercial Market: Shrinking

9.2% fewer lots sold

9.8% less money raised

66.8% success rate

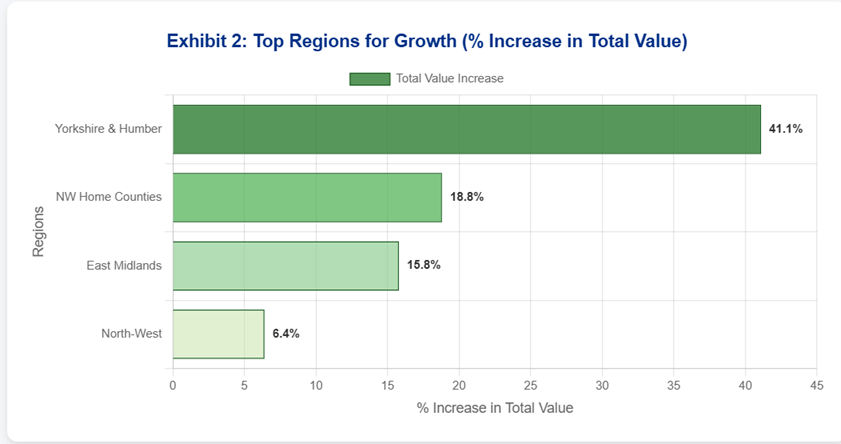

Best regions for growth

Yorkshire & the humber

41.1% increase in total value

66.8% increase in residential money raised

Early-stage market expansion

2. North-West home counties

18.8% increase in total value

72.1% success rate (above average)

Stable, premium market

3. East midlands

15.8% increase in total value

30.7% increase in commercial (rare growth)

Strong commercial opportunities

4. North-west

6.4% increase in total value

7.3% more lots sold

Broad market growth

Best regions for bargains

London

£290.1M market (largest in UK)

9.6% decline in total value

74.0% success rate (highest nationally)

Commercial properties down 33.9%

2. South-east home counties

£278.8M market (second largest)

7.8% decline in total value

Traditional premium market on sale

Where to find the best deals

For growth investors:

Yorkshire residential (66.8% growth)

East Midlands commercial (30.7% growth)

For value investors:

London commercial (33.9% price drop)

South-East residential (7.8% decline)

For easy wins (less competition):

Scotland (35.5% success rate)

Northern Ireland (37.2% success rate)

Key opportunities by property type

Residential: Best volume growth in North-West, East Anglia, South-West

Commercial: Major discounts in London, South-West, Scotland

Bottom line

Different regions are performing very differently.

Yorkshire and East Midlands offer the best growth opportunities, while London and South-East provide value opportunities with temporary price drops.

Scotland and Northern Ireland have the least competition, making them easier markets for new buyers.

Most investors walk into an auction room praying they don’t get carried away. Kiran walked in with a plan and a joint venture partner, and walked out with a West Ealing freehold for just £244,000.

In London terms, that’s like buying champagne at lemonade prices.

But here’s where it gets interesting: she didn’t use a single pound of her own money.

The Playbook

Step 1: Spotting the angle

The property was a tired shop in a busy West Ealing parade. Long, deep, with wasted storage at the back. Most buyers saw “problem property.” Kiran saw permitted development gold.

Keep a smaller, business-rate-free retail unit at the front.

Carve out the rear into a bright, self-contained flat with its own courtyard and skylight.

Why does this work? Because low-value commercial space converts into high-value residential at more than double the £/sqft. That’s instant equity creation.

Step 2: Controlling the asset

At auction, bidding crept past her limit. She held her nerve and stopped at £244k. For West London freehold rights, that’s a steal.

Step 3: Structuring with OPM (Other People’s Money)

A bridging lender funded 65% of the purchase.

A private investor fronted the rest of the equity and the build costs.

Together they formed an SPV, split 50/50. Kiran did the work, both share the profit.

Result: Kiran owns half a deal worth far more than her investor’s cheque — without risking her own capital.

The Numbers (why this is a slam dunk)

Purchase price: £244,000

Conversion cost: ~£40k–50k (for the flat split and finish)

Resale value of the flat: £325k–350k (confirmed by local agents)

Value of the retained shop: attractive rental unit, business-rate-free, in a high-demand parade.

On completion

The back flat alone could exceed the entire auction purchase price.

The front shop becomes pure upside — rental yield or further disposal.

Gross uplift: £150k+ equity gain in months, on someone else’s money.

Why this works anywhere high-value

The strategy is simple physics of property:

In high-value areas (London, SE, commuter belts), residential £/sqft > commercial £/sqft.

Add permitted development rights = instant arbitrage.

In low-value areas (say, Northern towns with £50k flats), the maths doesn’t stack. Conversion costs eat the margin.

Kiran approached it in a way that made the numbers clearly point to a "no-brainer" decision.

That's it for this week folks. Each week we'll cover strategies, updates and insights to help you succeed in real estate. We love this stuff!

If you Have questions or just want to chat, We want to hear it.

See you next time in your inbox!

What did you think of this Newsletter?

🤜🤛 Loving Chubby Wallet? Make our day and forward this to a friend.