- Chubby Wallet

- Posts

- Auction trends for smart investors

Auction trends for smart investors

What's selling and why..

Hi there,

This is Chubby Wallet. your 'property lifeguard' – here to save you from drowning in information overload.

Here's what’s in store..

General market update

Rents jumped over 14% in July

Auction trends to watch

The UK property market is cruising at its sweet spot. Chris Watkin's latest data shows 64,200 mortgage approvals in June – just shy of the 65,000 benchmark for healthy momentum.

New listings hit 33,000 in Week 29, maintaining 7% more inventory than pre-pandemic levels.

The reality check

One in seven properties gets a price reduction each month – that's 100,000+ monthly adjustments,

Alarming?

Not really. With 14.1% of properties reducing prices versus the 5-year average of 10.6%, we're simply finding natural equilibrium, as Adam Lawrence of Propenomix notes

The affordability angle everyone's missing

Housing affordability is at its best level in a decade.

The Nationwide House Price Index shows the house price-to-earnings ratio has dropped to 2013 levels while earnings growth outpaces house price increases.

Annual price growth of 2.4% sits comfortably below inflation and wage rises.

Mortgage rates

The Bank of England's Money and Credit report reveals new mortgage rates dropped 13 basis points to 4.34% – a significant monthly shift.

Remortgages hit 41,800, the highest since October 2022.

Translation?

People are accepting the new rate environment and moving forward with plans.

What's driving momentum

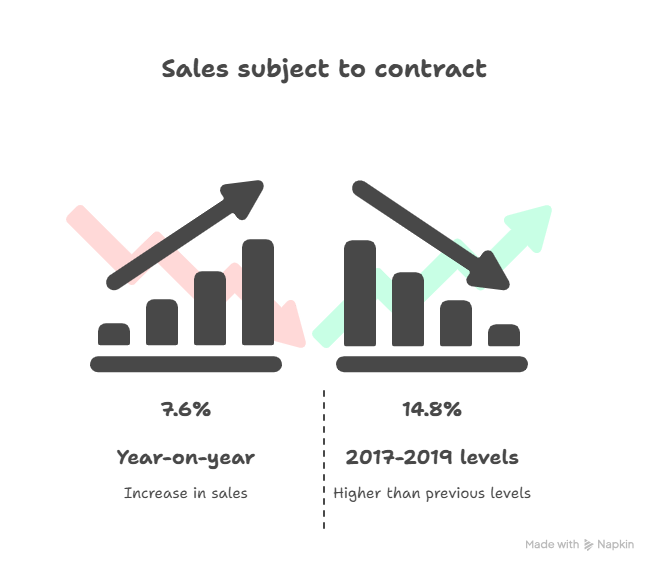

Sales subject to contract up 7.6% year-on-year 14.8% higher than 2017-2019 levels £7.8 billion increase in household deposits (Bank of England data)

Consumer credit growing at controlled 6.7% annually

The risks

Productivity challenged and political uncertainty remains the wild card that could disrupt things...

But these are sentiment risks, not cracks in the property market foundation.

The 2025 outlook

Expect 2.5% annual house price growth – modest, sustainable, realistic.

Mortgage rates should moderate further without returning to ultra-low pandemic levels, based on current Bank of England policy trajectory.

Your action plan

Buyers: Stop waiting for a crash that may never come. The market rewards patience and preparation over panic.

Sellers: Price realistically from day one, The "try it high" strategy is dead.

Investors: Focus on fundamentals – location, yields, demographics – not short-term price movements.

Average rents in England hit a record £1,496 in July, surpassing last year’s high of £1,470. according to the Goodlord rental index

This marks a recurring seasonal spike tied to student moves, graduate relocations, and school-year planning.

Monthly surge, annual slowdown

Rents jumped 18.3% from June — a typical July pattern — but annual growth slowed to 1.8% (down from 4% in February), signaling a broader market cooling.

Biggest Jumps: North West (+42%), South West (+34%), North East (+27%)

More Stable: Greater London (+4%), South East (+6%) On average, July movers paid £231 more per month than in June.

Void Periods Drop Sharply Average vacancy fell from 20 days in June to 12 in July. In the North West, voids plummeted from 22 to 5 days — indicating intense demand.

The bigger picture

Year-on-year data shows rental figures trending down, pointing toward correction rather than runaway inflation.

Landlords: July is your peak pricing window.

Tenants: Avoid July moves if possible.

Investors: Target steady-growth, higher value regions

The auction market right now feels like it’s stuck between gears.

Rising rates, skittish buyers, economic uncertainty — yet somehow, deals are still happening…

According to Allsop auction, they made over £1 billion in transaction value last year, with £400 million already raised in H1 this year alone.

So what’s happening?

Let’s break it down…

Motivation is the new momentum

Richard Adamson from Allsop’s draws a key distinction: motivated sellers ≠ desperate ones.

These are sellers who know what they’re doing.

Think housing associations or councils offloading tired legacy stock — not out of panic, but pragmatism.

They’re choosing to liquidate older, capital-hungry assets and reinvest in efficient new-builds.

The auction room isn’t a last resort; it’s a strategy.

This tells us something

Auctions, in particular, are becoming a clearer lens through which to see true market value — a litmus test of sorts.

The Buyer pool is shallow

The picture pained in the latest auction data is one of buyers waiting, watching, and hesitant to dive in amid geopolitical noise and domestic instability.

But here’s the twist:

This thin pool is good news for the brave.

Fewer bidders = less competition.

For savvy investors, this is a rare window to find value others are too cautious to chase.

Expect this to shift as interest rates ease and economic signals stabilize. Once the "wait-and-see" crowd sees rates come downward, expect the dam to break.

Is the high street dead? Not quite.

Two examples stand out:

Bishop’s Stortford: retail rent jumps from £50k to £87k.

A bank building in a "soft" town sells well above guide price.

The lesson?

Location still reigns. Investors are targeting retail spots with potential — either due to tenant resilience or adaptability (think mixed-use conversions, leisure hubs, or community parades).

Retail rents post-COVID have “re-based,” but crucially, they've also stabilized. And in uncertain markets, predictability is golden.

Residential reality check

Yields Are Back in Vogue…

Gone are the days of passive capital growth doing all the heavy lifting. Residential investors today are thinking more like their commercial counterparts:

“What’s my income yield?”

With house prices flattening, smart landlords are focusing on income-first models. Buy-to-let investors with high-yield criteria and value-driven strategies are making a comeback.

And auctions are perfect for this. Especially when cash buyers can move quickly on distressed or underutilized stock.

Vacant Units = Creative Capital

Old M&S buildings. Empty student blocks. Dead retail shells.

These are being snapped up by opportunistic, imaginative investors — think go-kart tracks, indoor golf, or hybrid leisure/retail hubs.

It’s a clear signal: buyers are not running from vacant units; they’re repurposing them.

The example of the student accommodation block in Birmingham — sold for £1.3 million vs. a £200k guide — shows the power of strategic pricing and trust in the auction mechanism.

Set the bait right, and the market will bite…

Outlook: The opportunity in uncertainty

the market is complex. Yes, risk exists. But clarity is returning.

Interest rates are stabilizing. Sellers are acting rationally.

Auctions are proving efficient. And value — not just hype — is driving deals.

So what should you do?

👉 Landlords: Re-evaluate your portfolio for yield, not just capital appreciation.

👉 Buyers: Don’t wait for perfect certainty

👉 Sellers: Strategic pricing, especially via auctions, can unlock serious upside.

👉 Investors: Look where others aren’t. Vacant = potential.

Picture this: a teenage boy boards a flight from Cyprus to London with just £20 and a suitcase of dreams. No contacts. No safety net. Just raw hunger.

That boy was Christos Lazari.

At 16, he swapped his sleepy village of Dora for the dizzying hustle of 1960s London.

He washed dishes, waited tables, and studied fashion by night.

Some people dream of a better life. Lazari scrubbed cutlery and made it happen.

And within a few short years, he launched Drendie Girl, a women’s fashion brand that punched far above its weight. London’s high street couldn’t get enough.

But this wasn’t the final act. It was only the warm-up.

The Big Pivot

In the late ‘70s, when most successful fashion moguls were popping champagne, Lazari was poring over property listings.

Why?

Because he understood something most people miss: fashion is trend-driven. Property, when done right, builds generational wealth.

Armed with profits from Drendie Girl and the intuition of a builder’s son, he made his first deal in 1978—a retail parade on Camden High Street, complete with flats above.

It wasn’t glamorous, but it was strategic. Mixed-use, income-generating, and in a part of London with upside.

That one deal laid the foundation for Lazari Investments—a family business, with an obsessive focus on value-rich, underappreciated real estate.

By 1984, he was no longer playing it safe. Lazari went all in, acquiring the Art Deco Shropshire House in Fitzrovia, a bold move that screamed confidence.

Scaling

While others chased “hot” new areas, Lazari doubled down on Central London’s golden postcodes—Mayfair, Baker Street, Fitzrovia, Bloomsbury.

His strategy was simple but brutal:

Buy undervalued assets in trophy locations

Reposition them with discipline

Hold long

Reinvest relentlessly

No flipping. No fads. Just compounding.

By the 2010s, he had amassed 2.5 million sq ft of prime space. Six estates accounted for over 90% of his portfolio.

He engineered his own pressure

Rather than coast on cashflow, he reinvested aggressively, often taking on large acquisitions that stretched the business. That self-imposed constraint kept him sharp.

Despite managing a £2B empire, Lazari wasn’t your typical suit.

He personally inspected his buildings, often on weekends. He knew his tenants. He handpicked acquisitions.

In 2015, when he passed, Lazari left more than buildings. He left a blueprint.

Takeaways

Start small, but think big. His first deal wasn’t sexy. It was smart.

Use early success as fuel. Fashion gave him capital. Property gave him wealth.

Concentrate where you understand. He went deep in Central London, not wide across the UK.

Make your capital uncomfortable. Lazari didn’t hoard cash—he put it to work.

Stay hands-on. No spreadsheet ever told him what a building smelled like at midnight.

That's it for this week folks. Each week we'll cover strategies, updates and insights to help you succeed in real estate. We love this stuff!

If you Have questions or just want to chat, We want to hear it.

See you next time in your inbox!

What did you think of this Newsletter?

🤜🤛 Loving Chubby Wallet? Make our day and forward this to a friend.