- Chubby Wallet

- Posts

- 5 myths stopping residential landlords from switching to commercial

5 myths stopping residential landlords from switching to commercial

Why this is the best time to start..

Hi there,

This is Chubby Wallet. The newsletter that teaches you how to profit from property trends before they go mainstream..

Here's what’s in store..

General market update

Renters right bill: 10 tips to reduce risks

Why this is the best time for landlords to switch to commercial

The UK housing market is holding steady, with no wild swings in sight…

Drawing on Chris Watkin’s Week 37 data, alongside Zoopla, Rightmove, and ONS insights, here’s our take on trends, economic drivers, and what’s shaping the landscape.

Expect modest growth, balanced supply and demand, and affordability challenges, with government policies and interest rates steering the ship...

Supply and demand

Supply is up, with 736,333 homes listed as of September 2025, per Watkin—a 10% surplus over historical averages, driven by landlords exiting due to potential tax hikes and older homeowners downsizing.

Year-to-date, 1.34 million homes hit the market, 2.8% above 2024’s pace.

Yet, demand is solid: 25.3k homes sold subject to contract (SSTC) in Week 37, up 5.9% year-on-year and 13.5% above 2017-19 levels.

Zoopla notes a 4% rise in sales agreed, fueled by a 30% jump in first-time buyer mortgages in H1 2025.

More stock gives buyers leverage, but steady sales signal a functional market.

Interest rates

The Bank of England held at 4% in September after a 0.25% cut in August, with two-year fixed mortgages at 5.48%.

Rightmove reports a 0.5% drop in two-year rates since August, shaving £100-200 off monthly payments on a £200k loan.

Gilt yields rose to 4.186% by late September because investors are anticipating slower or fewer Bank of England rate cuts if inflation remains around the forecasted 4%.

CBRE predicts lower debt costs in 2026, but global uncertainty could keep lenders cautious. For now, rates support buyers without sparking a boom.

Affordability: progress, but pain persists

Affordability—how much income buys a home—remains tough.

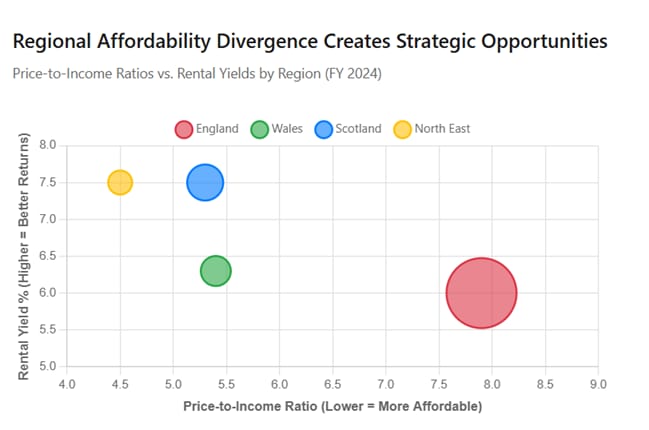

ONS data for FY 2024 shows England’s median house price-to-income ratio at 7.9x (down from 8.68x in 2023), with Wales at 5.4x and Scotland at 5.3x.

Zoopla pegs average prices at £271k, up 1.4% annually, while Nationwide notes a surprise September uptick. Wages (up 4.7%) outpace inflation, but high deposits (£187k for London buy-to-let, per Zoopla) and rates keep homes out of reach for many.

Rentals are softening—Zoopla’s Donnell calls it:

The weakest market in five years, with new lets up 2.4% to £1,301 and supply up 19%.

ONS reports private rents at £1,348, eating 36% of tenant income. Lower migration and more first-time buyers are cooling demand, but affordability is still strained.

Opportunities and risks

Expect 1.5-2% price growth in 2025, aligning with Watkin and HomeOwners Alliance’s 2-4% forecast.

Buyers benefit from high stock (9% more in the South, per Rightmove) and stable 25% fall-through rates.

Landlords see 6% yields on average (7.5% in North East/Scotland)

Risks?

November’s budget could raise personal taxes, denting confidence. PMI signals economic slowdown with 50k job losses in three months.

JRF warns housing costs may outpace inflation, hitting low-income households hardest. Regional gaps—South West prices down 1.3% vs. North West up 3.2%—show uneven growth.

Policies like rent reforms or capital gains tax changes could push more landlords out, shrinking the private rental sector

The Renters’ Rights Act, effective summer 2025, replacing Assured Shorthold Tenancies (ASTs, fixed-term rental contracts) with Assured Periodic Tenancies (APTs, ongoing month-to-month contracts).

Here’s a straightforward guide to the changes, risks, and how landlords can stay compliant.

Key changes

Ongoing tenancies: APTs mean tenancies continue indefinitely. Evictions require a Section 8 notice (a formal eviction process based on specific legal grounds).

Rent rules: List the proposed rent in ads—no bidding wars. Rent increases need a Section 13 notice (a formal rent hike request).

Tenant rights: Tenants can keep pets, with reasonable landlord objections allowed. Bans on children or benefit claimants are illegal.

Non-compliance risks

Violations can lead to fines or rent repayment orders. Avoid these mistakes:

Using old fixed-term contracts

Evicting without a Section 8 notice

Verbally asking tenants to leave

Omitting rent in ads.

Providing false info to the Landlord Database (a government system for tracking rentals).

10 Compliance Tips

Understand APTs: No fixed terms or advance rent. Evictions only via Section 8 grounds.

Know the Rules: Study the 13 new offenses. Update contracts and train staff

Vet Tenants Fairly: Use references from past landlords, meet tenants, check online profiles, but avoid discriminatory practices

Revise Policies: Remove “no pets” or “no benefits” clauses from contracts to align with the Act

Build Tenant Trust: Respond quickly, maintain properties, and discuss the Act with tenants

Inspect Regularly: Conduct “maintenance visits,” document findings, and meet insurance requirements

Prioritize Maintenance: Keep properties in top condition to meet the Decent Homes Standard (a quality benchmark) by 2035

Manage Arrears Early: Evictions for 3 months’ unpaid rent require a 4-week Section 8 notice. Offer payment plans or benefit guidance.

Keep Records: Store certificates, inspection reports, and communications for the Landlord Database and disputes.

Get Insurance: Rent guarantee insurance can protect against income loss during longer eviction processes.

Bottom Line

The Act boosts tenant protections, but proactive landlords can adapt. Update processes, maintain properties, and keep solid records to stay compliant by 2026.

If you’re a residential landlord, you’re likely feeling the heat from increasing government regulations like the Renters’ Reform Act.

Stricter rules, more compliance headaches, and less control over your investments can make the residential game feel like a treadmill.

If you’re ready to take your portfolio to new heights—bigger returns, less stress, more stability—commercial property is the answer.

Busting the Myths That Keep You Stuck

It’s Too Expensive to Get Started: Entry-level commercial deals—like small retail units, warehouses, or mixed-use properties—can cost the same as, or even less than, a typical family home in many markets.

Banks Won’t Touch It: Not true. Lenders are keen on commercial deals with strong tenants and solid leases. Unlike residential mortgages, where your personal income is scrutinized, commercial finance focuses on the lease’s strength and the tenant’s track record.

Voids Will Kill My Cashflow: Residential landlords dread tenant turnover, with 6–12 month tenancies leaving you chasing new renters or covering voids. Commercial is a different story. Tenants often sign leases for 3–15 years, locking in steady cashflow and minimizing empty properties.

It’s a Management Headache: Far from it. Most commercial leases are Full Repairing & Insuring (FR&I), meaning tenants take care of repairs, maintenance, and insurance. Your job? Collect the rent and focus on growing your portfolio.

It’s Too Risky: With proper due diligence, commercial can be less risky than residential. Long leases, often with upward-only rent reviews, provide predictable income and shield you from inflation. Strong tenant covenants—think established businesses or chains—add extra stability. Pick the right tenants, and you’ve got a safer bet than the unpredictable residential market.

Why Make the Switch Now?

Higher Returns: Better net yields mean more income from your investment, faster.

Stable Tenants: Long leases (3–15 years) deliver consistent cashflow with less turnover.

Less Hassle: Tenants handle most maintenance, freeing you to strategize, not micromanage.

Fewer Regulations: Commercial markets face less government interference, giving you more freedom.

How to Get Started

Start with entry-level properties like retail units or small offices in growing areas.

Team up with a broker who specializes in commercial finance

Research the market to identify high-demand locations and property types.

The residential game has been good to you, but with regulations like the Renters’ Reform Act tightening the screws, commercial is your way out.

That's it for this week folks. Each week we'll cover strategies, updates and insights to help you succeed in real estate. We love this stuff!

If you Have questions or just want to chat, We want to hear it.

See you next time in your inbox!

What did you think of this Newsletter?

🤜🤛 Loving Chubby Wallet? Make our day and forward this to a friend.